As 2024 unfolds, family offices face a rapidly changing landscape shaped by economic shifts, evolving investment opportunities, and the growing importance of sustainability. These entities, which manage the wealth and legacies of affluent families, must adapt to the challenges and opportunities of the modern world. Michael Shvartsman, a thought leader in investment and business strategy , highlights the importance of strategic planning. “Family offices are unique in their blend of personal values and financial goals. Staying agile and forward-thinking is essential for long-term success.”

Understanding Family Offices.

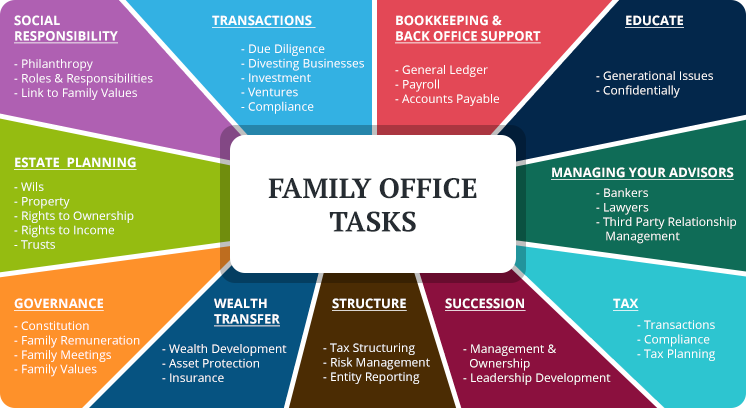

Family offices act as private wealth management firms dedicated to a single family or a small group. Their responsibilities range from investment management and tax planning to legacy preservation and philanthropic endeavors. Unlike traditional wealth managers, family offices take a more personalized approach, aligning financial strategies with the family’s broader vision.

Top Considerations for Family Offices in 2024.

1. Adapting to Market Volatility:

Global markets are experiencing fluctuations due to geopolitical uncertainties, inflation concerns, and technological disruptions. Family offices must stay informed and adapt their strategies to balance risk and opportunity. Michael Shvartsman advises, “Diversification is critical. Family offices should explore a range of asset classes and geographies to reduce exposure to any single market.”

2. Incorporating ESG Principles:

Environmental, social, and governance (ESG) considerations are shaping investment decisions. As clients increasingly prioritize sustainability, family offices must incorporate ESG metrics into their strategies to align with values-driven investment trends.

3. Technology and Cybersecurity:

The digital transformation of finance demands that family offices adopt advanced technology for the following:

- asset management,

- reporting,

- and communication.

Simultaneously, cybersecurity is becoming an essential focus to protect sensitive data and assets. “Technology offers incredible tools for efficiency and insight,” Michael Shvartsman notes. “However, robust security measures are equally important to safeguard the family’s interests.”

4. Intergenerational Wealth Transfer:

Many family offices are navigating the complexities of transferring wealth to the next generation. This requires clear communication, education, and the establishment of governance structures to ensure a smooth transition.

5. Exploring Alternative Investments:

Private equity, venture capital, and real assets like real estate and infrastructure continue to attract attention. These alternatives provide diversification and potential for outsized returns in uncertain economic conditions.

6. Philanthropy and Impact:

The next generation often emphasizes giving back to society. Family offices can support philanthropic initiatives that align with the family’s values, enhancing their legacy while creating meaningful change.

7. Customized Succession Planning:

Succession planning remains a priority, particularly for multi-generational families. Establishing leadership structures and clearly defining roles ensures continuity and preserves the family’s mission.

Challenges for Family Offices.

Family offices often operate in environments of competing priorities, such as managing short-term liquidity needs while pursuing long-term growth. Additionally, staying ahead of regulatory changes and navigating geopolitical risks require constant vigilance. Michael Shvartsman points out, “The complexity of managing wealth across generations, markets, and causes requires a mix of expertise, adaptability, and collaboration. The right approach is one that balances ambition with thoughtful decision-making.”

Strategic Steps for 2024.

- Engage Specialists

Partnering with experts in fields like tax planning, ESG investing, and estate law provides family offices with insights that enhance decision-making. - Strengthen Family Governance

Creating clear governance structures ensures that everyone in the family has a voice while maintaining alignment with shared goals. - Prioritize Education

Educating younger generations about wealth management fosters responsibility and prepares them to take on leadership roles. - Regularly Reassess Goals

Families evolve, and so do their priorities. Conducting periodic reviews ensures the family office remains aligned with its mission and objectives. - Stay Agile

The ability to pivot quickly in response to global events or market shifts is a competitive advantage for family offices in uncertain times.

Michael Shvartsman’s View on Family Office Success.

Michael Shvartsman underscores the importance of clarity and purpose. “A family office succeeds when it not only manages wealth effectively but also reflects the family’s values and aspirations. Thoughtful planning, combined with a commitment to adaptability, ensures that the family’s legacy endures.”

Michael Shvartsman also emphasizes the human element: “A family office isn’t just about financial assets—it’s about people, relationships, and shared dreams. Recognizing this adds depth and meaning to every decision.”

Family offices play a pivotal role in preserving and growing wealth while reflecting the personal values of their clients. In 2024, they must navigate a complex array of challenges and opportunities, from adapting to market trends to embracing technology and sustainability.

By taking a thoughtful and strategic approach, family offices can not only protect the assets they oversee but also contribute positively to the lives of the families they serve and the broader communities they touch.